We wrote about the relief for robotization for the first time over a year ago. Legislative work on this significant facilitation for companies willing to invest in new technologies has been significantly prolonged. Finally, on November 15 this year. amendment to the Corporate Income Tax Act as part of the so-called The Polish Order, containing relief for robotization, was signed by the President of the Republic of Poland. Thus, the new tax preference will enter into force from January 1, 2022.For the next 5 years, until the end of the tax year 2026.

The robotization relief will work similarly to the existing one R&D relief. This means that a taxpayer running a production activity who has invested in the purchase of new robots will be able to deduct 50% of the eligible costs incurred for this purpose from the tax base.

Who can benefit from the relief?

The relief for robotization is available to all companies, regardless of their size or industry, so it will cover both PIT and CIT taxpayers who invest in robotization. Expenses must be tax-deductible to be recognized as part of the relief.

What investments can be deducted under the robotization tax relief?

The catalog of eligible costs includes:

- purchase or leasing ofnew robots and cobots,

- purchase of software necessary for the correct launch and use of robots, cobots and other fixed assets in the field of robotics,

- purchase of equipment, e.g. tracks, turntables, controllers, motion sensors, end effectors, devices for human-machine interaction,

- purchase of equipment ensuring work safety and ergonomics (safety locks, covers, fences, scanners, curtains),

- costs related to the acquisition of intangible assets necessary to launch and put into use industrial robots,

- cost of training for employees who will operate the new equipment.

As you can see, investments covered by the relief apply only to the purchase of new robots. It is also worth paying attention to the definitions of an industrial robot and machines and peripheral devices for robots contained in the Act.

In 2020, WObit, as a robot manufacturer, together with representatives of all large robot suppliers in Poland, participated in consultations aimed at developing a coherent understanding of the subject of the relief for the entire industry. The definitions agreed in the consultation are set out below.

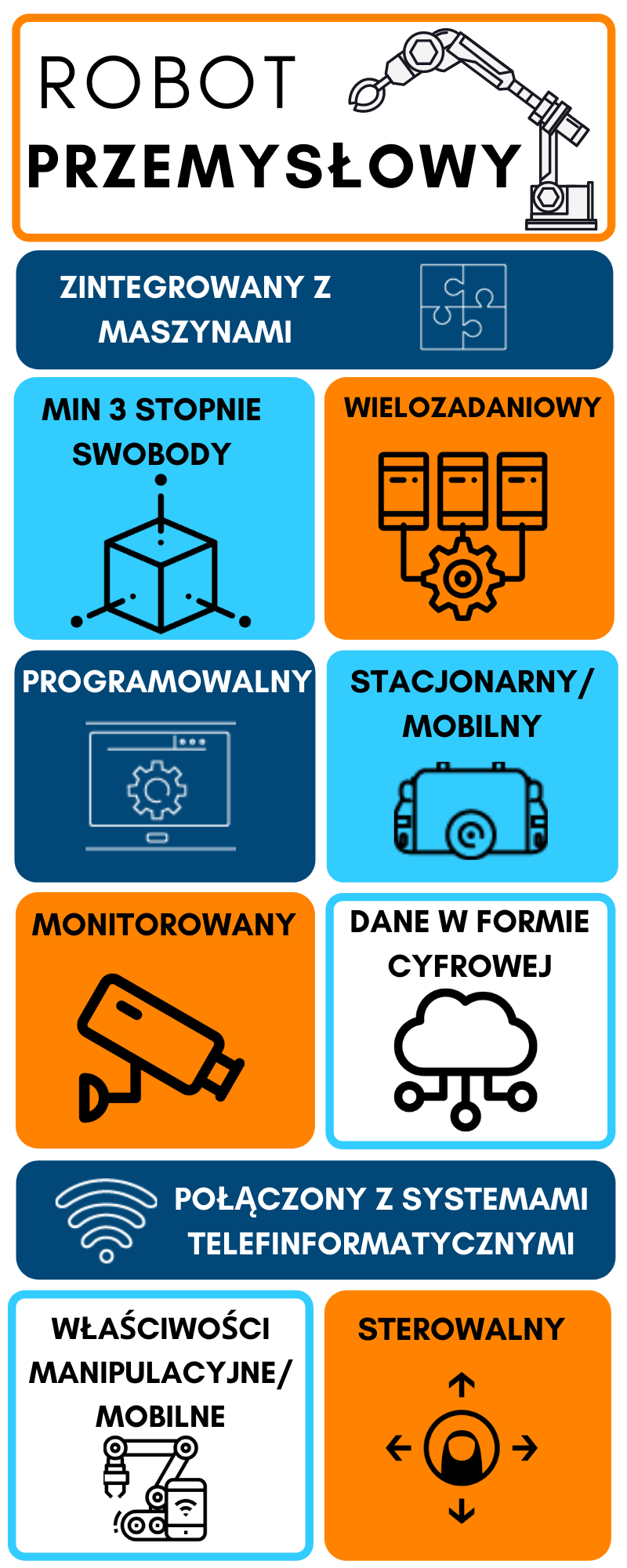

Industrial robot in accordance with the definition adopted in the Act is:

an automatically controlled, programmable, multi-tasking and stationary or mobile machine, must have at least 3 degrees of freedom, manipulation or locomotion properties for industrial applications, which meets all of the following conditions:

- exchanges data in digital form with control and diagnostic or monitoring devices for remote control, programming, monitoring or diagnosis;

- is connected to ICT systems that improve the taxpayer's production processes, in particular with production management, planning or product design systems;

- is monitored using sensors, cameras or other similar devices;

- is integrated with other machines in the taxpayer's production cycle.

Machines and peripheral devices for industrial robotsfunctionally related to them include in particular: linear units increasing freedom of movement, single- and multi-axis positioners, running tracks, poles and booms, rotators, positioners, cleaning stations, automatic charging stations, loading or receiving stations, collision joints.

These devices also include robot end effectors for interacting with the environment for:

- applying coatings, painting, varnishing, dispensing, gluing, sealing, welding, cutting, including laser cutting, bending, deburring, shot-blasting, sandblasting, grinding, polishing, cleaning, brushing, scratching, surface finishing, bricklaying, die-casting, soldering, welding, clinching, drilling, handling, including manipulation, transfer and assembly, loading and unloading, packaging, nailing, palletizing and depalletizing, sorting, mixing, testing, measuring,

- operation of machines: milling machines, injection molding machines, bending machines, robodrilles, drills, lathes, spindles, bending and wrapping machines, cutting machines, rolling machines, cutting machines, grinders, boring machines, drawing machines, printers, presses, spinning machines.

What to pay attention to?

To benefit from the robotization relief, it is necessary to submit a list of deductible costs incurred to the tax office by the deadline for submitting the tax return. Therefore, it is worth keeping records of costs incurred due to robotization and automation, as well as monitoring the records of fixed assets on an ongoing basis. The amount of the deduction cannot exceed the amount of income obtained by the taxpayer in the tax year from income other than capital gains.

What is the purpose of the relief and why is it worth using?

The purpose of the relief is to support the development of Polish enterprises that want to modernize through automation and robotization. Despite the increase in the robotization density rate last year, Poland remains one of the least robotized and automated countries in the European Union. Rising labor costs and the shortage of skilled workers, as well as rising energy costs and inflation make it essential to invest in tools that will help optimize manufacturing processes, significantly reduce costs and improve efficiency. Industrial robots are such a tool, as they enable improvement of the quality and efficiency of processes, thus increasing the competitiveness of the company and opening up new development opportunities. Taking advantage of the new relief will allow you to reduce the costs of investing in the robot by the value of the relief, and thus increase ROI. Therefore, it is worth analyzing investment plans for the next 5 years and taking advantage of new development opportunities.

We invite you to talk about robotization and automation of production processes with our experts. Zapytaj, czy robotyzacja sprawdzi się w Twojej firmie oraz od czego zacząć modernizację. Dowiedz się, które rozwiązanie będzie optymalne do Twojej aplikacji. Skorzystaj z doświadczenia i wiedzy polskiego producenta robotów przemysłowych, w tym autonomicznych robotów mobilnych MOBOT® i układów kartezjańskich.

Make an appointment for a meeting, conversation or presentation of the robot in Your company. Call +48 61 2227 410 or use the contact form.

Sources:

https://isap.sejm.gov.pl /isap.nsf/download.xsp/WDU19920210086/U/D19920086Lj.pdf

https://www.biznes.gov.pl/pl/portal/001099

Infographic icons:

Did you get interested in this article?

If you have any question contact our specialists.